The voluntary local currency known as Goldbacks brings together physical 24-karat gold to perform as a tool for executing small financial deals. These alternative local currency units differ from fiat currencies because they obtain their value from physical gold, whereas traditional currencies depend on central bank governance. Since their launch in 2019, Goldbacks have started to spread throughout select U.S. states as people talk about their ability to replace standard currency. The following article investigates the foundation and acceptance process of Goldbacks alongside their value assessment and potential to challenge fiat currency systems as a mainstream solution.

The Origins and Purpose of Goldbacks

The idea in the lower back of Goldbacks emerged from a choice to create a gold-based, overseas money suitable for everyday transactions. While gold has been used as money for centuries, its excessive price relative to its weight makes it impractical for small purchases. Traditional gold coins and bullion are tough to divide into smaller denominations due to wanting a more handy gold-backed medium of change.

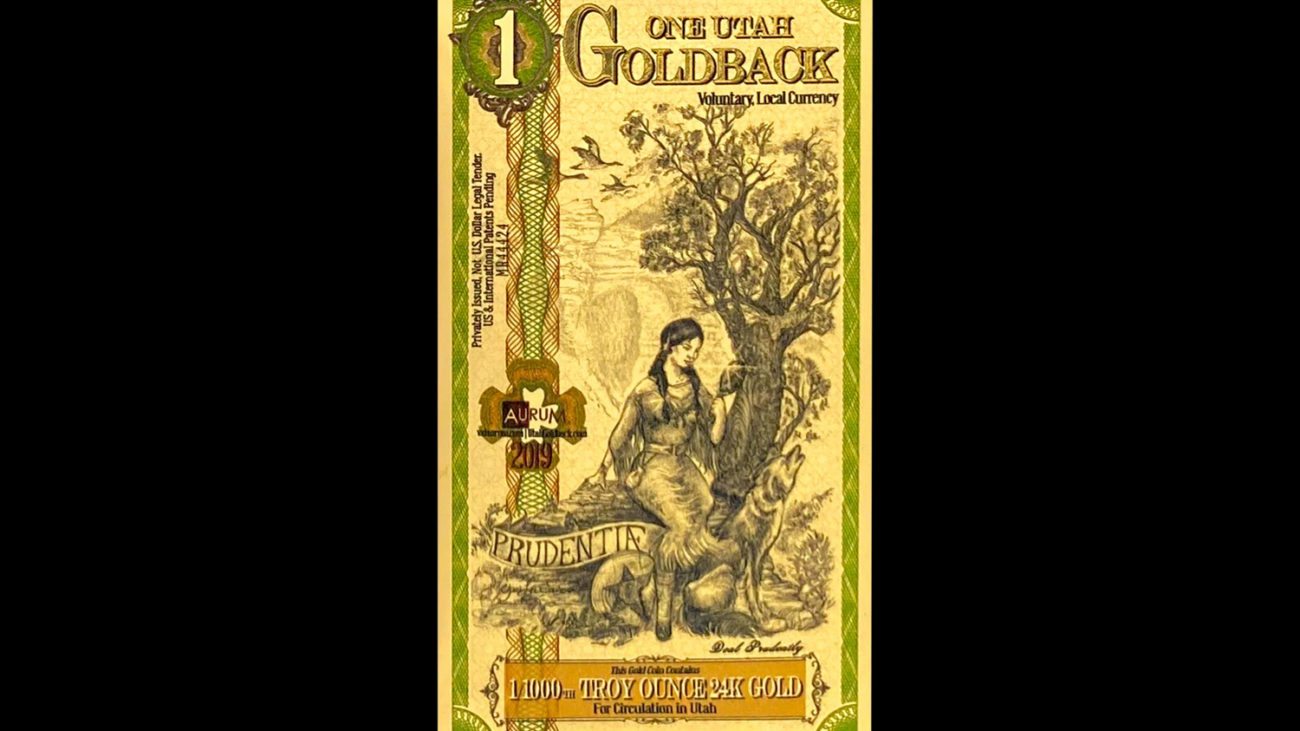

The first Goldbacks have been introduced in Utah on July 17, 2019, at the Freedom Festival in Las Vegas, Nevada. Their initial alternate price has become $2.25 in line with Goldback, reflecting both the cost of the gold content material and the top magnificence associated with manufacturing expenses. The foreign exchange isends designed to be both long-lasting and delightful, with each be aware containing a unique amount of pure gold encased in a polymer fabric to save you put on and degradation.

The denominations available include 1, five, 10, 25, and 50 Goldbacks, much like 1/one thousandth, five/1000ths, 10/1000ths, 25/1000ths, and 50/1000ths of a troy ounce of gold, respectively. This particular allocation of gold guarantees that Goldbacks hold an intrinsic fee, making them extremely good from fiat currencies, which are based totally on recall in authorities establishments in preference to tangible property.

Adoption and Circulation within the United States

Since their launch, Goldbacks have accelerated beyond Utah and are clearly circulating in multiple states, including Nevada, New Hampshire, Wyoming, and South Dakota. The adoption of Goldbacks has been driven by a developing distrust of government-issued foreign money and problems regarding inflation, which erodes the buying power of conventional cash.

Local corporations in the United States have embraced Goldbacks as an alternative method of charge. While Goldbacks aren’t diagnosed as felony by the manner of the federal government, they are carried out voluntary agreements amongst agencies and customers. In a few regions, as much as 50% of small organizations take shipping of Goldbacks, demonstrating a sturdy interest in alternative currencies. To help the developing purchaser base, directories have been created to listlist buyers that take delivery of Goldbacks, making it less complicated for human beings to combine them into their daily transactions.

Despite their growing reputation, Goldbacks face disturbing conditions in accomplishing a significant reputation. Their voluntary nature means that businesses want to be willing to accept them, which requires teaching the general public about their price and capability. Unlike traditional coins, which can be used anywhere within their jurisdiction, Goldbacks rely on a gap marketplace that has to hold to expand to remain feasible.

Valuation and Exchange Rates

The cost of Goldbacks is immediately linked to the spot rate of gold, but they are often exchanged at a pinnacle class because of manufacturing prices and their specific format. Each Goldback consists of a selected fraction of a troy ounce of gold, and its trade price is often updated to mirror fluctuations inside the gold market. This ensures that Goldbacks constantly shop for energy relative to the price of gold, making them a reliable hold of value.

For instance, if the encouraged alternate price is $five constant with Goldback, a 50 Goldback examination might be well worth $250. This pricing model allows Goldbacks to feature further to fiat currency, with denominations that can be used for ordinary transactions. However, the pinnacle class over the gold spot rate has led a few critics to argue that Goldbacks are not a price-effective manner to preserve gold. While traditional gold coins and bullion offer a more direct way to put money into gold, Goldbacks provide the advantage of divisibility and portability, making them extra sensible for everyday use.

Another factor affecting valuation is supply and demand. As more human beings undertake Goldbacks, their reputation as a medium of change grows, whiwhwhich mayght cause increased pricing balanceg. However, economic situations and adjustments in gold charges will preserve their standard well-worth.

Comparison to Traditional Cash

Goldbacks differ from traditional cash in numerous strategies, each with benefits and drawbacks. One of the most significant variations is their backing. While fiat currencies derive their value from government decrees and monetary regulations, Goldbacks are immediately tied to a tangible asset. This presents a degree of safety against inflation, which has been a growing challenge for many clients in recent years.

Despite their asset-subsidized nature, goldbacks face barriers compared to conventional coins. Fiat currency is universally conventional within its jurisdiction, making it reasonably reachable for transactions. In evaluation, Goldbacks require each occasion in a transaction to recognize and agree on their cost, which could complicate exchanges. Furthermore, the jail framework surrounding Goldbacks remains uncertain, as they are no longer officially recognized as criminal gentle. While they operate under the barriers of voluntary change agreements, substantial adoption could require new regulations to clarify their status and protect customers.

Another interest is stability. While Goldbacks preserve intrinsic fees via their gold content material material, they may be troubled by fluctuations inside the gold market. This can bring about variations in shopping strength, making them tons less predictable than fiat foreign exchange for everyday costs. Conversely, fiat currencies are a problem to inflation and depreciation over the years, eroding their lengthy-term cost. Consumers should weigh those elements while identifying whether or not to apply Goldbacks as an opportunity form of coins.

Challenges Facing Goldbacks

Several demanding situations must be addressed before Goldbacks become a mainstream currency. One of the most pressing problems is production expenses. The problematic manufacturing procedure required to embed gold into each word adds a top magnificence to their rate, making them more expensive than their uncooked gold content. While this ensures sturdiness and protection, it additionally means that clients pay extra for the advantage of using Goldbacks in comparison to one-of-a-kind kinds of gold ownership.

Counterfeiting is every other concern. Although Goldbacks are designed with advanced protection abilities, the threat of fraudulent replicas exists. Ensuring the public accepts them as true with their authenticity may be important to their persevered fulfillment. Education campaigns and verification equipment ought to help mitigate this threat and increase client self-assurance.

Regulatory demanding conditions additionally pose a capacity obstacle. Goldbacks operate in a jail gray place do not use reputable government backing or oversight. While this allowsallows for extra economic freedom, it will also increase questions about their prolonged-term viability. If Goldbacks benefit massive traction, regulators may also bebe attempting to impose rules or new policies governing their use. Understanding and navigating those ability jail hurdles can be crucial for their persistent increase.

The Future of Goldbacks

The expansion of Goldbacks into a couple of states indicates a growing interest in opportunity currencies. As worries about inflation, financial instability, and authorities’ intervention preserve anupward thrust, more extraordinary human beings can also turn to Goldbacks as a steady cost-saving. If technological improvements can reduce manufacturing fees, Goldbacks may also need to be extra available to a broader goal market, in addition to growing their adoption.

However, for Goldbacks to replace cash on a massive scale, notable adjustments in client behavior and regulatory frameworks can be required. The current economic gadget is deeply entrenched, and fiat currencies remain the dominant medium of alternate global. While Goldbacks offer a concrete aggregate of intrinsic fee and portability, their capacity to function as a primary foreign exchange will rely on enormous elegance, crook popularity, and ongoing public schooling.

Conclusion

Goldbacks constitute a modern approach to forex, combining the enduring charge of gold with the convenience of cutting-edge banknotes. Their adoption in picking out U.S. States highlights a developing interest in asset-backed money and economic autonomy. While they will not be in all likelihood to replace conventional coins totally inside the close to destiny, Goldbacks offer a compelling possibility for those searching for stability in an uncertain economic landscape. As more people recognize their benefits and triumph over the related demanding situations, Goldbacks may additionally want to play a more and more vital function in the destiny of money.